Strategy: Trend Following

Clients are investing in a process rather than investing in any particular market or group of markets.

Purpose

The purpose of our Standard Diversified Strategy is to earn exceptional long-term returns, preserve upside equity potential, and limit downside risk in an uncertain world. Another goal is to generate a return stream which is non-correlated to traditional investments.

Trend Following

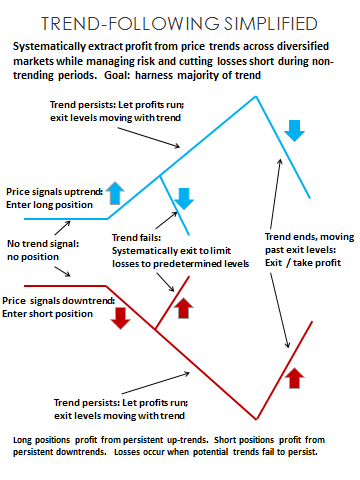

Trend-Following is the practice of aligning with price trends across diverse markets while managing risk during non-trending periods. Cut losses short and let winners run. We are riding market trends just as a surfer rides ocean waves. We do this quantitatively, systematically, and repeatedly. Aligning with price trend simply means objectively following where the money is going. Systematic diversified trend-following does not rely on human attempts to forecast market outcomes.

Who and Why

Investors would invest with Anderson Creek Trading if their goals are to:

- Seek superior long-term returns when compared to more traditional investments.

- Diversify traditional investments with a non-correlated strategy.

- Reduce overall long-term portfolio volatility.

- Increase long-term absolute and risk-adjusted returns for a portfolio.

- Access opportunities across wide variety of markets, rather than relying only on one or two markets such as stocks and bonds.

- Access opportunities in both bull and bear market environments rather than only relying on a bull market in stocks.

Philosophy Behind Our Strategy

Price Trends have formed throughout human history. We believe this is a natural characteristic of human action. Price trends form and are exploitable due to a number of factors including market adjustments over time to changing underlying economic factors, behavioral biases, and price-insensitive market participants such as hedgers. We believe long-term evidence suggests a diversified trend-following strategy can perform well through various market environments, in particular during persistent divergent trending periods.

The future is uncertain and unpredictable. Change is the only certainty. Price trends form as a symptom of change. Trends often begin without warning or recognition, lasting longer than expected, only to end when many believe they will continue indefinitely. Meanwhile, society as a whole might have difficulty recognizing and learning from these repeating themes. Individual assessment of risk is also unstable and rarely quantified. Therefore, navigating markets poses significant challenges for investors, but also offers opportunities for those prepared with strategies designed with these characteristics in mind.

Relying on a perpetual bull phase in any one market, sector, or grouping of highly correlated markets carries significant risks and increases the fragility of a portfolio. Alternatively, a systematic process designed to align with price trends in diversified markets has the potential to reduce these risks while also benefiting from change across markets.

Investors might even want to go so far as considering if an investment portfolio should start with diversified trend-following and only then consider adding buy-and-hold in stocks or some other single asset class to diversify the core trend-following strategy. Trend-following requires only a few large trends out of many diverse markets for success. Traditional investments by contrast require bull phases in one or two specific markets. We believe trend-following is far more robust than picking one or two markets and hoping for perpetual bull phases.

Rules Based and Systematic

We act according to a set of methodical rules which have been put together to form complete system. Decisions of what to trade at any given time, whether to position long or short or flat (no-position), and what position size to use are decisions which are made according to a set of quantitative rules. Likewise, decisions of when to exit positions for small loss, small gain or for larger gain are also systematic and quantitative.

Quantitative

Quantitative means we have measured mathematical values for our rules and system parameters.

Repeatable

Because decisions are rules based, systematic, and quantitative, our process is repeatable and testable. When the strategy was designed, our goal was to trade it for proprietary accounts over the ultra-long-term. We still plan to do this for ourselves. Through Anderson Creek Trading, we have opened the doors to clients who have similar goals and needs.

Markets

Anderson Creek Trading trades liquid exchange listed futures contracts in the following sectors: Grains, Soft Commodities, Meats, Energy, Metals, Foreign Currencies, Interest Rates, and Equity Indices. You can see more examples of the markets we trade on our Broad Diversification page.

Goals and Expectations

Our goal is to produce exceptional long-term compounded returns while achieving non-correlation with stock, bond, long-only commodity, long/short equity, private equity, and real estate. As previously mentioned, we have skin in the game and trade proprietary capital alongside clients using the same strategy. We believe non-correlated strategies add to the robustness of a portfolio. It is best if these non-correlated strategies can stand on their own as a return stream. Our opinion is that ACT’s systematic Standard Diversified Strategy, used alone or as part of a larger portfolio, has the potential to improve diversification over the long-term when added to a portfolio of more traditional assets such as equities, bonds, and real-estate.

Although our expectation is to successfully compound capital, we also expect to endure periods of drawdown and loss. Knowing ahead of time when periods of gain or periods of drawdown will occur is of course impossible. Lumpiness is expected and normal in our return profile or equity curve. With this in mind, investing and trading are viewed as a marathon rather than a sprint.

Belief in the robustness of the strategy led ACT’s founder to move from testing phase to live trading with proprietary capital during a then present strategy drawdown. When possible, proprietary capital has also been added during subsequent drawdown periods with the intention of benefiting slightly from those drawdowns. We never know ahead of time when drawdowns will end, but we believe using them for allocations is a wise choice.

No equity curve is a straight line. Positive returns each day, week, month, or even each year are generally not possible.

Although there is no lockup period with ACT, an investor needs to have a long-term time horizon to expect a better chance of success. What does this mean? Three years should be the minimum time the client expects to stay with ACT (again no lock up regardless). We believe 7-10 years and longer is a better choice. Additionally, we would have no problem if the client’s goal would be to allocate during a drawdown and then take some money off the table after a period of significant gains, leaving at least enough to cover minimum trading levels for continued investment.

There are no guarantees in life, and there is no guarantee we will be successful in our efforts. There is risk of loss, and we expect to endure some losing periods in our effort to compound returns.

THE RISK OF LOSS IN TRADING FUTURES CAN BE SUBSTANTIAL. YOU SHOULD, THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN LEAD TO LARGE LOSSES AS WELL AS GAINS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.